Food tax maryland is a subject of ongoing interest and debate, impacting both consumers and businesses across the state. This exploration delves into the intricacies of how food is taxed in Maryland, from its historical roots to its current application and implications. Understanding the food tax is crucial for residents, businesses, and policymakers alike.

The subsequent sections will provide a comprehensive examination of the food tax, starting with its basic premise and history. We will analyze taxable and non-taxable food items, explore exemptions and special cases, and assess the impact on consumers and businesses. Furthermore, we will delve into the legislative history, revenue allocation, public perception, and potential reforms related to this important aspect of Maryland’s fiscal landscape.

The geographical variations, if any, will also be examined.

Overview of Food Tax in Maryland

The food tax in Maryland, like those in many other states, is a sales tax applied to the purchase of certain food items. This tax impacts consumers and businesses alike, influencing the cost of groceries and prepared foods. Understanding the nuances of this tax is crucial for residents and those conducting business within the state.

Basic Premise of the Food Tax

The fundamental principle behind Maryland’s food tax is the application of a sales tax to specific food products. This tax is typically levied at the point of sale, meaning it is added to the final price consumers pay for eligible items. The revenue generated from this tax contributes to the state’s overall budget, funding various public services. The scope of the tax often includes items like groceries and prepared foods, although there can be exemptions.

History of Implementation and Changes

Maryland’s approach to taxing food has evolved over time. Initially, a general sales tax was applied to a broad range of goods, including food. Significant changes, such as the introduction of exemptions or reduced rates for certain food items, have been implemented to address concerns about the impact of the tax on low-income individuals and families. Legislative efforts have focused on refining the definition of “food” to clarify which items are subject to taxation and which are exempt.

Current Tax Rate on Food Items

The current tax rate applied to food items in Maryland is the standard state sales tax rate. It’s essential to understand the specific tax rate, as it can change. This rate is applied to most food items sold at grocery stores and other retail locations.To clarify the scope of taxable food, consider the following examples:

- Groceries: Most raw ingredients and staples purchased in grocery stores, such as fruits, vegetables, meats, and dairy products, are typically subject to the tax.

- Prepared Foods: Prepared foods, such as those sold in restaurants, fast-food establishments, and some deli counters, are usually subject to the tax.

- Exemptions: Some items may be exempt. For example, certain food items purchased with food stamps may be exempt from sales tax.

Taxable vs. Non-Taxable Food Items

Understanding which food items are subject to Maryland’s sales tax and which are exempt is crucial for both consumers and businesses. This distinction affects the final price of goods and influences purchasing decisions. The following sections detail the specifics of taxable and non-taxable food items.

Taxable Food Items

Certain food items are considered taxable under Maryland law. This typically includes prepared foods and certain types of beverages.

- Prepared Foods: These are items that are ready to eat or require minimal preparation. This includes food sold by restaurants, caterers, and certain grocery stores.

- Specific Beverages: Beverages like soft drinks, and other sweetened beverages are generally taxable.

Non-Taxable Food Items

A wide range of food items are exempt from Maryland’s sales tax, primarily focusing on basic grocery staples.

- Unprepared Food: Most food intended for home consumption is exempt. This includes items like fruits, vegetables, meats, and dairy products.

- Certain Beverages: Plain coffee, tea, and milk are typically not subject to sales tax.

Taxable and Non-Taxable Food Item Categories

To provide a clear overview, here is a table categorizing food items by their tax status. The information is for general guidance and should not be considered legal advice.

| Category | Tax Status | Examples of Taxable Items | Examples of Non-Taxable Items |

|---|---|---|---|

| Prepared Foods | Taxable | Sandwiches, hot meals, prepared salads sold at a deli counter, meals served in a restaurant | N/A |

| Beverages | Variable | Soft drinks, sweetened beverages, specialty coffee drinks | Plain coffee, tea, milk, water |

| Grocery Staples | Non-Taxable | N/A | Fresh fruits, vegetables, raw meats, dairy products, eggs, bread |

| Snack Foods | Variable | Chips, candy, cookies, items that are not considered essential food staples | Unprepared snack items such as plain nuts or seeds |

Exemptions and Special Cases

Maryland’s food tax, while broadly applicable, includes several exemptions and special considerations. These provisions aim to alleviate the tax burden on certain individuals and entities, as well as to clarify the tax’s application in specific circumstances. Understanding these exemptions is crucial for both consumers and businesses operating within the state.

Entities and Individuals Exempt from Food Tax

Certain entities and individuals are exempt from paying the Maryland food tax. These exemptions are designed to support specific populations or activities.

- Government Entities: Federal, state, and local government agencies are generally exempt from the food tax. This includes purchases made by government employees on official business.

- Non-Profit Organizations: Qualified non-profit organizations, such as charitable organizations and educational institutions, may be exempt from the food tax on certain purchases. However, the specific rules and requirements for this exemption can vary, and organizations must typically meet specific criteria to qualify.

- SNAP and WIC Recipients: Individuals using Supplemental Nutrition Assistance Program (SNAP) benefits and Women, Infants, and Children (WIC) benefits are exempt from the food tax when purchasing eligible food items. This exemption helps to ensure that low-income individuals and families can access essential food items without the added tax burden.

- Resale: Businesses purchasing food items for resale are generally exempt from the food tax. This allows businesses to avoid paying tax on items they will subsequently sell to consumers, ensuring that the tax is ultimately paid only by the end consumer.

Procedures for Claiming Exemptions

Claiming a food tax exemption requires specific procedures, depending on the type of exemption.

- Government Entities: Government agencies typically use their tax-exempt status when making purchases. This may involve providing a tax-exempt certificate or other documentation to the vendor at the time of purchase.

- Non-Profit Organizations: Non-profit organizations must typically register with the Maryland Comptroller’s Office and obtain a tax-exempt certificate. They must then provide this certificate to vendors when making eligible purchases. Organizations should maintain records of their tax-exempt purchases for audit purposes.

- SNAP and WIC Recipients: SNAP and WIC recipients use their benefit cards at participating retailers. The system automatically applies the exemption to eligible food purchases at the point of sale.

- Resale: Businesses purchasing food for resale must provide a resale certificate to their suppliers. This certificate confirms that the purchaser is a registered business and intends to resell the items, thereby exempting them from the food tax.

Application of Food Tax to Prepared Foods

The application of the food tax to prepared foods, particularly those sold in restaurants and similar establishments, is a significant aspect of the tax law. This includes meals, snacks, and beverages prepared for immediate consumption.

- Taxable Prepared Foods: Generally, prepared foods sold by restaurants, fast-food establishments, caterers, and other similar businesses are subject to the food tax. This includes meals consumed on the premises, as well as takeout and delivery orders.

- Definition of Prepared Food: Maryland law defines prepared food broadly, including food that is cooked, heated, mixed, or otherwise prepared for immediate consumption. This also includes items that are served with utensils, such as plates, cups, or cutlery, provided by the seller.

- Examples of Taxable Prepared Foods: Examples of taxable prepared foods include restaurant meals, sandwiches, pizza, hot dogs, salads, and prepared coffee or tea. The tax also applies to catered events and food truck sales.

- Exceptions: Certain items may be exempt from the food tax even when sold by a restaurant or similar establishment. For example, the sale of prepackaged food items, such as bags of chips or bottled beverages, may be exempt if the item is not intended for immediate consumption. This distinction can sometimes be complex, and businesses must carefully consider the nature of the food items they sell.

- Tax Collection: Businesses selling prepared foods are responsible for collecting the food tax from their customers and remitting it to the state. This requires businesses to track their sales of taxable prepared foods and accurately calculate the tax due.

Impact on Consumers

The food tax in Maryland directly influences the financial burden faced by consumers when purchasing groceries and dining out. This section examines the specific effects of the tax, compares Maryland’s rates with those of surrounding states, and analyzes potential shifts in consumer behavior due to the tax.

Cost of Groceries and Meals

The food tax in Maryland increases the overall cost of food purchases. This affects both groceries bought for home consumption and meals consumed at restaurants or other food service establishments.The impact of the tax is most apparent when comparing pre-tax and post-tax prices on grocery receipts or restaurant bills. For instance, a grocery bill of $100 before tax would incur a tax, leading to a higher final cost.

Similarly, a meal costing $50 would also be subject to the tax, increasing the total amount paid.

Comparison of Tax Rates

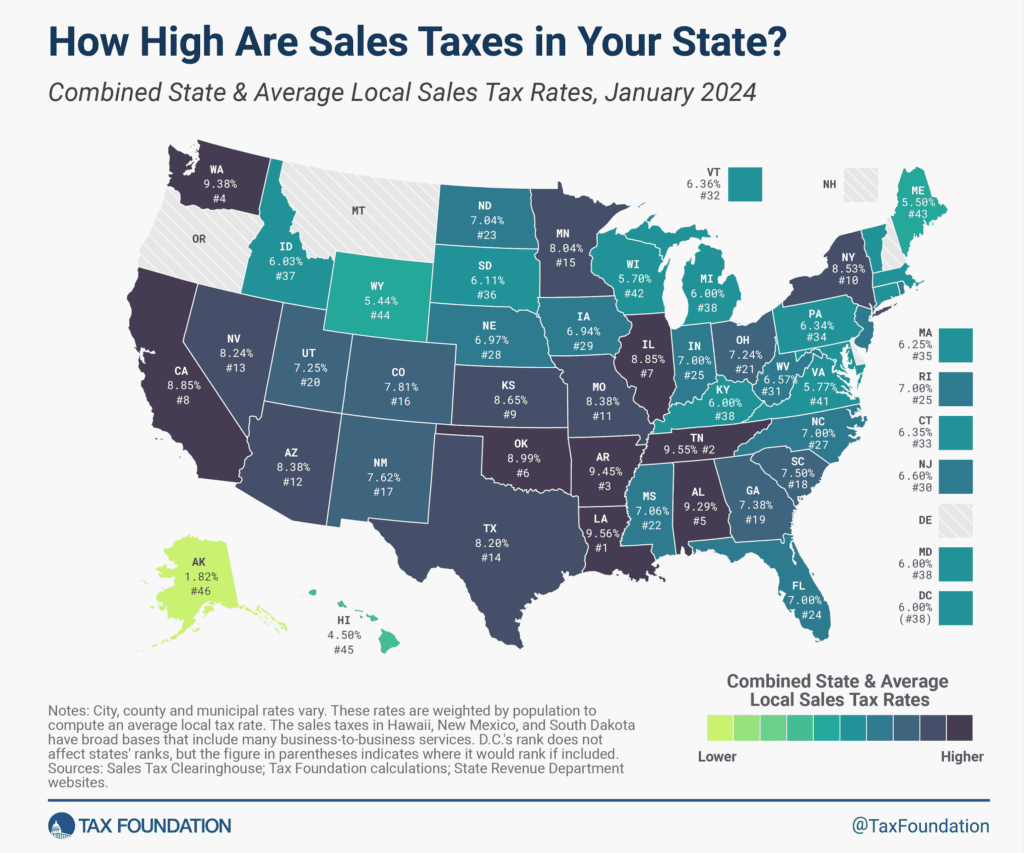

Maryland’s food tax rates can be assessed by comparing them to those in neighboring states. This comparison helps illustrate the relative cost burden on consumers in different geographic locations.Here’s a table comparing the general sales tax rates (which often apply to food) in Maryland and surrounding areas:

| State/Jurisdiction | General Sales Tax Rate (as of October 26, 2023) | Notes |

|---|---|---|

| Maryland | 6% | Applies to most food items, but certain exemptions exist (e.g., unprepared food for home consumption). |

| Delaware | 0% | Delaware has no state sales tax. |

| Pennsylvania | 6% | Applies to most food items, with some exceptions. |

| Virginia | 5.3% | Statewide sales tax, but localities can add their own. Grocery items are generally taxed at the state rate. |

| Washington, D.C. | 6% | Applies to most food items. |

This comparison demonstrates that Maryland’s sales tax rate on food is similar to that of Pennsylvania and Washington, D.C., but higher than Delaware’s (which has no sales tax). Virginia’s state rate is slightly lower.

Consumer Behaviors and Purchasing Habits

The presence of a food tax can influence consumer decisions in several ways, altering purchasing habits and potentially impacting the food service industry.The following are potential consumer behaviors influenced by the food tax:

- Shift towards Tax-Exempt Items: Consumers may choose to purchase more tax-exempt food items, such as groceries for home consumption, rather than prepared foods or restaurant meals to avoid the tax.

- Increased Home Cooking: Faced with higher costs at restaurants, consumers might opt to cook more meals at home, which may be cheaper overall due to the absence of the food tax on groceries.

- Cross-Border Shopping: Residents living near state borders might travel to neighboring states with lower or no sales tax on food (like Delaware) to purchase groceries or eat out, potentially impacting local businesses in Maryland.

- Budget Adjustments: Consumers might reduce spending on non-essential food items or adjust their overall budgets to accommodate the added cost of the food tax.

- Impact on Low-Income Households: The food tax can disproportionately affect low-income households, as a larger percentage of their income is typically spent on food.

Impact on Businesses

The food tax in Maryland significantly impacts businesses involved in the sale of food and beverages. These businesses bear the responsibility of collecting and remitting the tax, navigating complex regulations, and potentially facing increased operational costs. Understanding these impacts is crucial for businesses to ensure compliance and manage their financial obligations effectively.

Business Responsibility for Tax Collection and Remittance

Businesses operating in Maryland are legally obligated to collect and remit the food tax on all taxable food and beverage sales. This responsibility encompasses several key aspects, including determining taxability, calculating the tax amount, and submitting the collected funds to the state.The process for collecting and remitting the food tax involves:

- Determining Taxability: Businesses must accurately identify which food items are subject to the food tax. This requires a clear understanding of the definitions for taxable and non-taxable items, as Artikeld by Maryland tax regulations. For instance, pre-packaged snacks sold in a vending machine are generally taxable, while groceries purchased at a supermarket for home consumption are typically exempt.

- Calculating the Tax: Once the taxability of an item is confirmed, businesses must calculate the tax due. This involves applying the state’s food tax rate to the price of the taxable items. The tax rate, currently at 6% in Maryland, is applied to the total amount of the taxable food purchase.

- Collecting the Tax: Businesses must collect the food tax from customers at the point of sale. This collection should be clearly indicated on receipts, separating the food tax from the price of the items.

- Remitting the Tax: Businesses are required to remit the collected food tax to the Maryland Comptroller’s Office. The frequency of remittance (e.g., monthly, quarterly) depends on the business’s tax liability. Businesses typically use tax forms provided by the state to report their sales and tax payments.

- Record Keeping: Businesses must maintain accurate records of all taxable sales, tax collected, and tax payments. These records are essential for audits and compliance purposes. Proper record-keeping includes maintaining detailed sales invoices, receipts, and tax payment records.

Steps for Food Tax Compliance

To ensure compliance with Maryland’s food tax regulations, businesses should follow a structured approach. This involves establishing internal processes, staying informed about regulatory changes, and utilizing available resources.The key steps for compliance include:

- Registration: Businesses must register with the Maryland Comptroller’s Office to obtain a sales and use tax license, which is necessary for collecting and remitting the food tax. This process involves providing business information and agreeing to comply with state tax laws.

- Taxability Determination: Businesses must establish a clear system for determining the taxability of food items. This can involve creating internal guidelines, training employees on tax regulations, and regularly reviewing the tax status of products. For example, a restaurant might train its staff to distinguish between taxable prepared foods and non-taxable grocery items.

- Point-of-Sale System Updates: Businesses should ensure their point-of-sale (POS) systems are programmed to accurately calculate and collect the food tax. This may involve updating the system to reflect the current tax rate and automatically apply the tax to taxable items.

- Tax Collection and Record Keeping: Implementing a system for collecting the tax from customers and maintaining detailed records of all transactions is crucial. This includes issuing receipts that clearly show the tax amount and storing all sales data securely.

- Tax Filing and Payment: Businesses must file the required tax returns and remit the collected tax to the state on time. This requires understanding the filing frequency and deadlines set by the Comptroller’s Office. For example, a business might file and pay monthly if its tax liability exceeds a certain threshold.

- Ongoing Monitoring and Updates: Businesses should regularly monitor changes in tax laws and regulations to ensure continued compliance. This involves staying informed about any updates to the definition of taxable items or the tax rate.

Challenges Businesses Face

Businesses encounter several challenges related to food tax compliance. These challenges can increase operational costs, complicate accounting procedures, and potentially lead to penalties if not managed effectively.The primary challenges include:

- Complexity of Regulations: The food tax regulations can be complex and subject to interpretation. Businesses must navigate intricate definitions, exemptions, and special cases, which can be confusing and time-consuming. For example, distinguishing between “prepared foods” (taxable) and “groceries” (non-taxable) can be challenging.

- Accurate Product Classification: Businesses must accurately classify food items to determine their taxability. This requires detailed knowledge of product definitions and consistent application of tax rules. Incorrect classification can lead to underpayment or overpayment of taxes.

- POS System Management: Ensuring that point-of-sale systems are correctly programmed to calculate and collect the tax can be challenging. This involves regular updates, maintenance, and training for staff.

- Record-Keeping Requirements: Maintaining detailed and accurate records of all taxable sales and tax payments can be burdensome. This includes tracking sales data, storing receipts, and reconciling tax payments.

- Compliance Costs: Businesses incur costs associated with tax compliance, including software updates, staff training, and professional accounting services. These costs can be particularly significant for small businesses.

- Audit Risk: Businesses face the risk of audits by the Maryland Comptroller’s Office. Failure to comply with tax regulations can result in penalties, interest charges, and legal action.

Legislative History and Current Laws

The food tax in Maryland has evolved through various legislative actions, shaping its current structure and application. Understanding this history is crucial for comprehending the nuances of the tax and its impact. The legislative journey reflects changing economic conditions, societal priorities, and political debates.

Key Legislative Acts and Bills

The food tax in Maryland has been modified by various bills and acts over time. These legislative actions have altered the scope of the tax, exemptions, and revenue allocation.

Discover more by delving into sensitive stomach dog food wet further.

- Early Legislation: Initial legislation established the foundation for the sales tax, which included food. The specific dates and bill numbers would be crucial for pinpointing the initial framework. For example, the initial sales tax law would have set the base rate and defined what constituted taxable goods, including food items.

- Exemption for Prepared Foods (If Applicable): Certain legislation may have created specific exemptions for prepared foods sold at restaurants or similar establishments. This could involve differentiating between groceries and ready-to-eat meals. The details of these bills would clarify the exact parameters of these exemptions.

- Changes in Tax Rates: Various bills could have adjusted the overall sales tax rate, indirectly affecting the tax on food. Even small percentage changes can have significant impacts on revenue generation and consumer spending.

- Specific Food Tax Legislation: Specific bills were possibly introduced that directly addressed the food tax, modifying exemptions or altering how the tax was applied to certain food items. This would encompass any legislation directly targeting the food tax.

- Revenue Allocation Bills: Legislation may have been enacted to specify how the revenue generated from the food tax was allocated. This could include allocations to specific state funds, education, or other programs.

Current Legal Framework and Regulations

The current legal framework for the food tax in Maryland is primarily found in the state’s tax code and associated regulations. These documents provide detailed guidance on the application of the tax.

- Maryland Tax Code: The primary source for the food tax is the Maryland Tax Code. This code contains the statutory language that defines the tax, including the tax base (what is taxed), the tax rate, and exemptions. For example, the code would Artikel the specific definitions of “food” and “food products” for tax purposes.

- Maryland Regulations: Regulations issued by the Maryland Comptroller’s Office provide further clarification and interpretation of the tax code. These regulations offer more specific guidance on how the tax is applied in practice. These regulations often address complex issues, such as how the tax applies to combined food and non-food items or food sold through various channels.

- Comptroller’s Office Guidance: The Maryland Comptroller’s Office publishes various documents, such as guidance documents, rulings, and frequently asked questions (FAQs), to assist businesses and consumers in understanding the tax laws. These resources are invaluable for practical application.

- Judicial Precedents: Court decisions related to the food tax also form part of the legal framework. These precedents clarify the interpretation of the tax laws and regulations.

Proposed Changes and Debates

The food tax in Maryland has been subject to ongoing debates and potential legislative changes. These discussions often center on the tax’s impact on consumers, businesses, and state revenue.

- Exemption Proposals: One common debate involves proposals to exempt certain food items or categories of food from the tax. This could include proposals to exempt all groceries, or specific items deemed essential. Such proposals often aim to reduce the financial burden on low-income households.

- Rate Adjustments: Discussions sometimes arise regarding adjusting the tax rate on food. This could involve lowering the rate to reduce consumer costs or increasing the rate to generate more revenue for the state.

- Impact on Revenue: Proposed changes are often evaluated based on their potential impact on state revenue. Estimations of the revenue effects are crucial in the decision-making process. For instance, a proposal to exempt groceries would require estimating the revenue loss and the potential benefits.

- Economic Impact Studies: Legislative discussions frequently involve economic impact studies to assess the potential effects of proposed changes on businesses and consumers.

- Political Considerations: Political factors play a significant role in these debates. This includes the political climate, the priorities of lawmakers, and the influence of lobbying groups.

Revenue Generated and Allocation

The revenue generated from Maryland’s food tax plays a significant role in the state’s financial landscape. Understanding the amount of revenue generated and how it is allocated is crucial for assessing the tax’s impact on both the state’s budget and the services it provides to its citizens.

Annual Revenue Generation

Maryland’s food tax generates a substantial amount of revenue each year. The precise figures fluctuate based on economic conditions and consumer spending habits.* The total annual revenue generated by the food tax is in the millions of dollars. This figure is derived from the state’s taxation reports.

Allocation of Revenue

The revenue collected from the food tax is directed to various state programs and services.* The revenue from the food tax is deposited into the state’s general fund.

- From the general fund, the revenue is then allocated to support a wide array of public services, including education, healthcare, infrastructure projects, and public safety initiatives.

- The specific allocation of funds is determined through the state’s budgetary process, which involves legislative review and approval.

Economic Impact of Revenue

The economic impact of the food tax revenue is multifaceted, affecting the state’s budget and the availability of public services.* The revenue from the food tax contributes to the overall fiscal health of Maryland. It helps to balance the state’s budget and ensures the continuation of essential services.

- The availability of funds from the food tax supports the funding of programs, such as the Maryland public school system, and assists in the allocation of resources to local communities.

- The consistent revenue stream from the food tax provides a degree of stability to the state’s financial planning. This allows for more predictable budgeting and the ability to address unforeseen economic challenges.

- The allocation of funds is crucial in determining the level of funding for public services, impacting areas like the number of teachers in schools, the resources available to healthcare providers, and the extent of infrastructure improvements.

Public Perception and Opinions

The public’s perception of Maryland’s food tax is multifaceted, reflecting a range of opinions influenced by factors such as economic standing, political affiliation, and personal experiences. The tax, often perceived as a regressive tax, disproportionately affects low-income individuals and families, leading to significant debate about its fairness and impact on affordability.

Arguments For and Against the Food Tax

The arguments surrounding the food tax in Maryland are varied, with proponents and opponents offering distinct perspectives. These viewpoints often stem from differing economic philosophies and concerns about social equity.

- Arguments in favor of the food tax often center on its role in generating revenue for the state. Proponents highlight the tax’s contribution to funding essential public services, such as education, infrastructure, and social programs.

- Some argue that the tax is relatively small on individual purchases and does not significantly impact overall household budgets.

- Furthermore, proponents may suggest that the tax is a necessary component of a balanced budget, providing a stable source of funding regardless of economic fluctuations.

- Conversely, opponents of the food tax primarily focus on its regressive nature, emphasizing that it places a greater burden on low-income individuals and families.

- They argue that the tax reduces the purchasing power of those who can least afford it, potentially exacerbating economic disparities.

- Opponents also point out that the tax can make it more difficult for families to afford basic necessities, such as groceries, and may contribute to food insecurity.

- Some advocate for the elimination of the food tax or for alternative revenue sources that are less burdensome on low-income residents.

Diverse Perspectives on the Food Tax

The following blockquote contains diverse perspectives on the food tax in Maryland, including quotes from stakeholders, providing a nuanced understanding of the issue.

“The food tax is a vital revenue stream that helps fund critical state services, ensuring the well-being of all Marylanders.”

-*Statement from a Maryland State Legislator, supporting the tax.*“This tax disproportionately hurts the families who are already struggling to make ends meet. It’s a regressive tax that needs to be eliminated.”

-*Comment from a representative of a Maryland food bank, opposing the tax.*“While the tax might seem small on individual items, it adds up over time, especially for families with several children. It impacts our ability to provide healthy meals.”

-*Quote from a Maryland resident.*“We need to find alternative ways to fund our state’s needs that don’t place such a heavy burden on the most vulnerable members of our community.”

-*Opinion from a local community organizer.*

Alternatives and Potential Reforms

The current food tax in Maryland, while generating revenue, has faced scrutiny regarding its impact on low-income residents and the complexities it introduces for businesses. Exploring alternative tax structures and potential reforms is crucial to ensure fairness, efficiency, and economic stability. These alternatives aim to address the drawbacks of the existing system and potentially improve the overall economic well-being of Maryland residents.

Potential Alternatives to the Current Food Tax System

Several alternative tax structures could replace or modify the existing food tax. Each option presents its own set of advantages and disadvantages, requiring careful consideration of their potential impacts on consumers, businesses, and state revenue.

- Elimination of the Food Tax: This involves completely removing the tax on food purchases. This would directly benefit consumers, especially those with lower incomes, as it reduces their overall cost of living. However, it would also result in a loss of revenue for the state, potentially requiring cuts in government spending or increases in other taxes to compensate. The economic impact would be a redistribution of wealth, with a greater proportion staying with consumers.

- Reduced Food Tax Rate: Instead of complete elimination, the state could reduce the food tax rate. This offers a compromise, lessening the financial burden on consumers while mitigating the revenue loss. The degree of benefit would depend on the extent of the reduction. A smaller reduction might have a limited impact, while a more significant decrease could offer substantial relief.

- Tax Credits or Rebates: Implementing tax credits or rebates specifically targeted at low-income individuals or families could offset the impact of the food tax. This approach allows the state to provide financial assistance to those most affected by the tax, while still maintaining the tax revenue. The effectiveness of this strategy depends on the design and implementation of the credit or rebate program.

- Consumption Tax on a Broader Base: This involves shifting the tax burden to a wider range of goods and services, potentially lowering the tax rate on food. This could provide more revenue, reduce the reliance on food taxes, and potentially make the tax system more equitable. This shift would necessitate a careful analysis of the economic impact on different sectors and income groups.

- Value-Added Tax (VAT): A VAT is a consumption tax levied at each stage of production, based on the value added. It is generally considered more efficient and less prone to evasion than sales taxes. Implementing a VAT would require significant changes to the state’s tax administration system and could affect the prices of various goods and services.

Comparison of Alternative Tax Structures: Advantages and Disadvantages

Each alternative tax structure has unique advantages and disadvantages. The choice of the most suitable alternative requires a careful evaluation of these factors, considering the state’s economic goals, revenue needs, and commitment to social equity.

| Alternative | Advantages | Disadvantages |

|---|---|---|

| Elimination of Food Tax | Benefits low-income consumers; Simplifies tax system. | Significant revenue loss; Requires adjustments in other taxes or spending. |

| Reduced Food Tax Rate | Provides some relief to consumers; Mitigates revenue loss compared to complete elimination. | Less impactful than complete elimination; Benefit depends on the degree of reduction. |

| Tax Credits/Rebates | Targeted relief for low-income individuals; Maintains tax revenue. | Administrative complexity; Requires effective program design and implementation. |

| Consumption Tax on a Broader Base | Potentially more revenue; May allow for a lower food tax rate; Can improve fairness. | Requires careful analysis of economic impacts; Could increase prices on other goods and services. |

| Value-Added Tax (VAT) | More efficient; Less prone to evasion; Broader tax base. | Significant administrative changes; Could impact prices and businesses. |

Potential Reforms or Adjustments to the Food Tax

Beyond considering alternative tax structures, several specific reforms or adjustments could improve the existing food tax system in Maryland. These adjustments aim to address specific issues and make the tax more equitable and efficient.

- Expand Exemptions: Expanding the list of food items exempt from the tax could provide relief to consumers. For example, exempting all prepared foods or increasing the exemption for specific types of food. This could involve broadening the definition of “food” to include more items, such as some non-essential groceries.

- Simplify Tax Regulations: Streamlining the regulations surrounding the food tax could reduce the burden on businesses. Clearer definitions of taxable and non-taxable items, as well as simplified reporting requirements, could help. This would help businesses understand and comply with the tax laws, reducing the administrative burden.

- Improve Enforcement: Enhancing enforcement efforts could ensure that all businesses comply with the tax laws. This could involve increased audits and stricter penalties for non-compliance. Effective enforcement is critical to maintaining the integrity of the tax system and ensuring that all businesses are treated fairly.

- Increase Transparency: Improving the transparency of the tax revenue allocation could build public trust. Publicly reporting how the food tax revenue is used could increase public confidence in the tax system. This could include providing detailed information on how the funds are allocated to various state programs.

- Regular Review and Adjustment: Establishing a system for regularly reviewing and adjusting the food tax based on economic conditions and public feedback is essential. This would allow the state to respond to changing economic circumstances and ensure the tax remains fair and effective. This could involve periodic assessments of the tax’s impact on consumers and businesses.

Geographic Considerations

The application of Maryland’s food tax is primarily uniform across the state, but subtle variations and local ordinances can create differences in how the tax impacts consumers and businesses in different areas. While the state sets the overall framework, local jurisdictions may introduce supplementary regulations or policies that indirectly affect the cost and availability of food items.

Local Ordinances and Policies, Food tax maryland

Local ordinances and policies in Maryland can affect the food tax in a variety of ways, even though the state tax generally applies uniformly. These influences typically relate to zoning, business licensing, and local incentives, which can indirectly impact the cost of food.

- Zoning Regulations: Zoning laws in specific municipalities can influence where grocery stores, restaurants, and food vendors can operate. Restrictions on the size of businesses or the types of food they can sell, for example, might affect the overall cost structure, which in turn could influence the final prices.

- Business Licensing Fees: Different counties or municipalities may charge varying business licensing fees. Higher fees for restaurants or grocery stores could lead to slightly higher prices for consumers to offset these costs.

- Local Incentives: Some jurisdictions might offer tax breaks or incentives to businesses that promote healthy food options or operate in underserved areas. These incentives could potentially lower the cost of certain food items or make them more accessible.

- Special Events and Temporary Vendors: Local ordinances may govern the application of the food tax at special events or for temporary food vendors, such as farmers’ markets or food trucks. The tax might be collected differently or be subject to specific exemptions based on local regulations.

Influence of Geographic Location on Food Costs

Geographic location significantly influences the cost of food for consumers in Maryland. Factors such as transportation costs, the availability of food suppliers, and the presence of local competition all play a role in determining prices.

- Proximity to Suppliers: Areas closer to food distributors and wholesalers, often found in more urban or suburban areas, may benefit from lower transportation costs, which can translate to lower food prices. Rural areas, further from suppliers, may experience higher prices.

- Transportation Costs: The cost of transporting food to a specific location impacts the final price. Areas with better infrastructure, such as well-maintained roads and efficient transportation networks, might see lower prices compared to areas with less developed infrastructure.

- Competition: The level of competition among food retailers in a particular area can affect prices. Areas with multiple grocery stores and restaurants often experience more competitive pricing, while areas with limited options may have higher prices.

- Income Levels: Consumer income levels in different geographic locations can influence the types of food available and the prices. Affluent areas might have a greater selection of specialty or organic foods, often at higher prices, while lower-income areas might have fewer options and higher prices for basic necessities.

- Examples of Price Variations: A study comparing the cost of groceries in different Maryland counties revealed that the same basket of goods could vary in price by as much as 10-15% depending on the location. This variance is due to factors like transportation, competition, and the presence of large grocery chains.

Final Thoughts: Food Tax Maryland

In conclusion, the food tax in Maryland presents a complex interplay of economic, social, and legislative factors. From its impact on consumer spending to its contribution to state revenue, this tax policy is a key component of Maryland’s financial system. The ongoing discussions surrounding potential reforms and the public’s diverse perspectives highlight the dynamic nature of this tax. As Maryland continues to evolve, the food tax will undoubtedly remain a topic of significance, requiring careful consideration of its various facets.