SINGAPORE – Leading measurement and analysis company Adjust released “The Shopping App Insights Report” to prepare mobile marketers for the fourth quarter shopping season and beyond into 2025. Shopping app installs outperformed the overall industry average, increasing 61% year-over-year in the first half of 2024, while overall e-commerce app installs increased 25% and session count increased 13% year-over-year. This growth comes as retail media networks continue to grow, next-generation digital shopping experiences are rolled out, and mobile wallets become commonplace.

“Shopping apps are changing the way consumers interact with brands and make purchases,” said Tiahn Wetzler, director for Content & Insights at Adjust“By working with AI and augmented reality and integrating dynamic channels like social commerce and CTV, marketers can increase user engagement and create experiences that lead to high conversion rates.”

Marketers should keep an eye on the fourth quarter buying season, which leads to large increases in installations. In a survey by InMobi In Asia, 73% of respondents in Indonesia, Singapore and the Philippines plan to use a mix of in-person and mobile shopping. Adjust recorded installs 40% above the daily average on October 17, 2023 and 41% higher on October 18.

Adjust's Shopping App Insights report provides eCommerce app marketers and developers with key insights across all major sub-segments. Highlights include:

- The average session duration for e-commerce apps in E-APAC was 10 minutesa slight decrease from the global average of 10.5 minutes. However, the region had a 15% retention rate on the first day In comparison, the rates in North America and Latin America were 11% and 14.4% respectively.

- APAC had the highest number of partners per appand rose from 10.7 to 11.8 from 2023 to the first half of 2024.

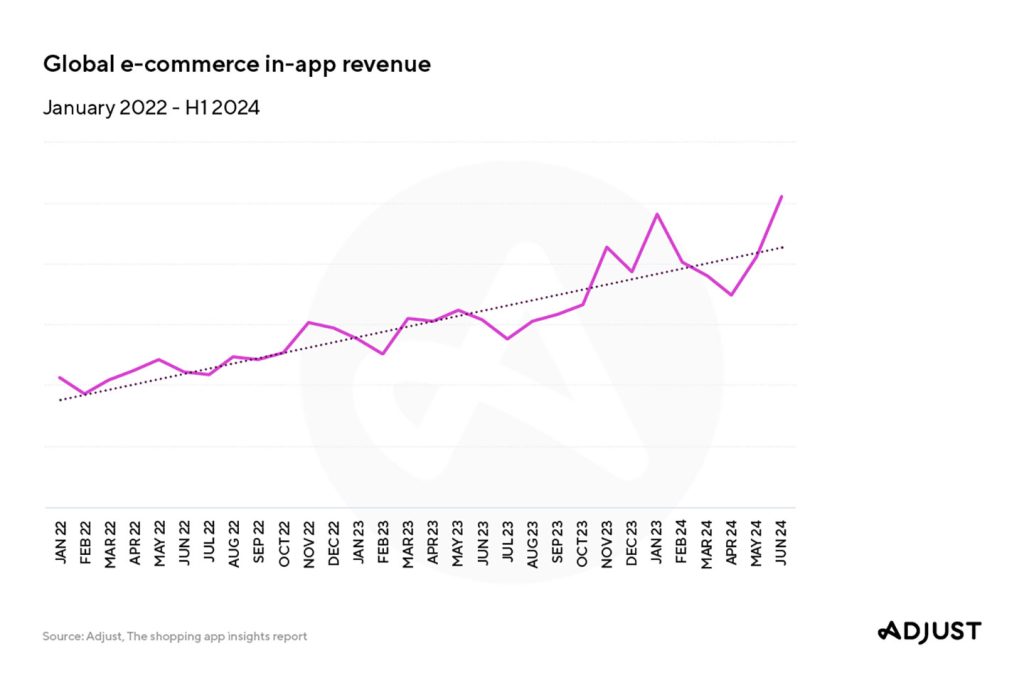

- In-app revenue for e-commerce apps increased 36% year-over-year. 60% of in-app revenue worldwide comes from Android devices. The biggest peaks in 2023 occurred in the fourth quarter, with revenues 34% above the monthly average in November and 22% above the monthly average in December.

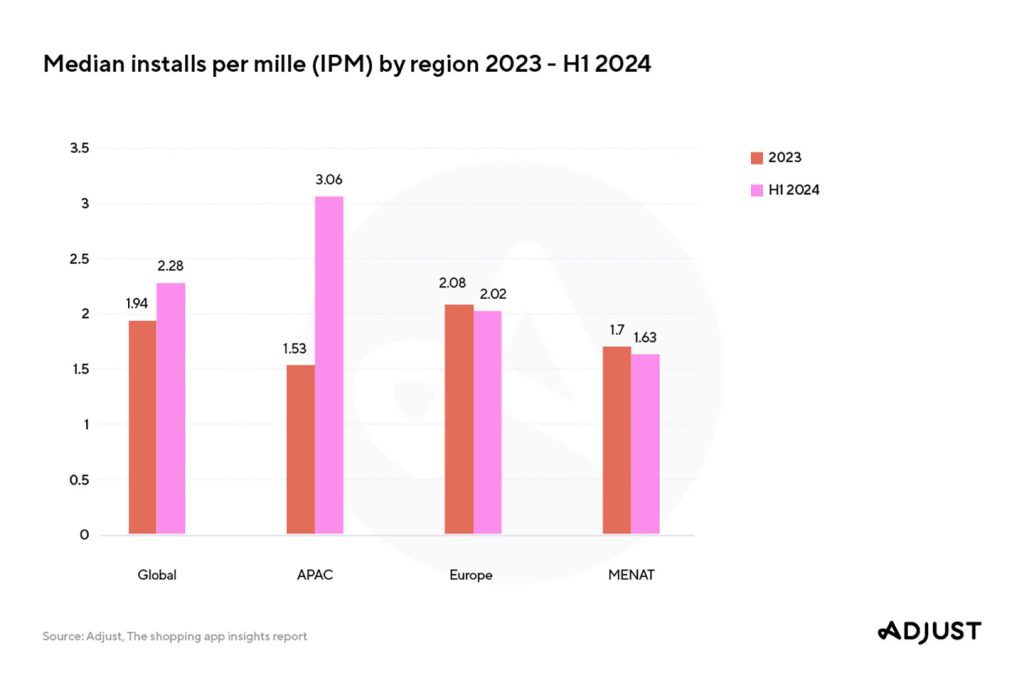

- Global median installations per mille (IPM) increased from 1.94 in 2023 to 2.28 in the first half of 2024.which indicates improved effectiveness of advertising campaigns. APAC recorded a significant increase from 1.53 to 3.06.

“In a competitive market where engagement and loyalty are critical to driving profits, meeting the expectations of consumers across all generations – and leveraging the technology behind them – is paramount,” Tiahn continued. “As the shopping app landscape evolves, scalable growth will be achieved through a strategic channel mix, intelligent personalization, and a data-driven approach to measurement and analytics.”

“As shopping habits rapidly change with the advancement of e-commerce technology, it is extremely valuable for marketers and retailers to refine their campaign strategies to ensure optimal growth and success, especially in the APAC region,” said April Taylor, Regional Vice President for INSEAU at Adjust. Our data shows that several Southeast Asian countries such as Indonesia, Malaysia, the Philippines, Singapore and Vietnam spend a lot of time in apps. This is an opportunity for companies to capitalize on this trend, which is likely to continue to grow in the foreseeable future.”

For further insights and analysis, download the full report Here.