As global markets react to expected interest rate cuts in the US, Hong Kong's Hang Seng Index has proven resilient and risen despite a weak economic calendar and cautious sentiment. In this context, dividend stocks can offer stability and income potential, making them attractive to investors looking for reliable returns despite market fluctuations. When selecting dividend stocks, it is important to consider companies with solid financial strength and a consistent payout history. These characteristics can provide a buffer against volatility and ensure stable income streams even in uncertain times.

The 10 largest dividend stocks in Hong Kong

|

name |

Dividend yield |

Dividend valuation |

|

Luk Fook Holdings (International) (SEHK:590) |

9.59% |

★★★★★☆ |

|

Sinopharm Group (SEHK:1099) |

5.15% |

★★★★★☆ |

|

China Construction Bank (SEHK:939) |

7.64% |

★★★★★☆ |

|

China Electronics Huada Technology (SEHK:85) |

9.81% |

★★★★★☆ |

|

SAS Dragon Holdings (SEHK:1184) |

9.26% |

★★★★★☆ |

|

Chongqing Rural Commercial Bank (SEHK:3618) |

8.22% |

★★★★★☆ |

|

China Resources Land (SEHK:1109) |

7.28% |

★★★★★☆ |

|

Zhongsheng Group Holdings (SEHK:881) |

8.97% |

★★★★★☆ |

|

PC Partner Group (SEHK:1263) |

8.77% |

★★★★★☆ |

|

Bank of China (SEHK:3988) |

7.25% |

★★★★★☆ |

Click here to see the full list of 80 stocks from our top SEHK dividend stocks screener.

We'll look at some of the best tips from our screener tool.

Simply Wall St Dividend Rating: ★★★★☆☆

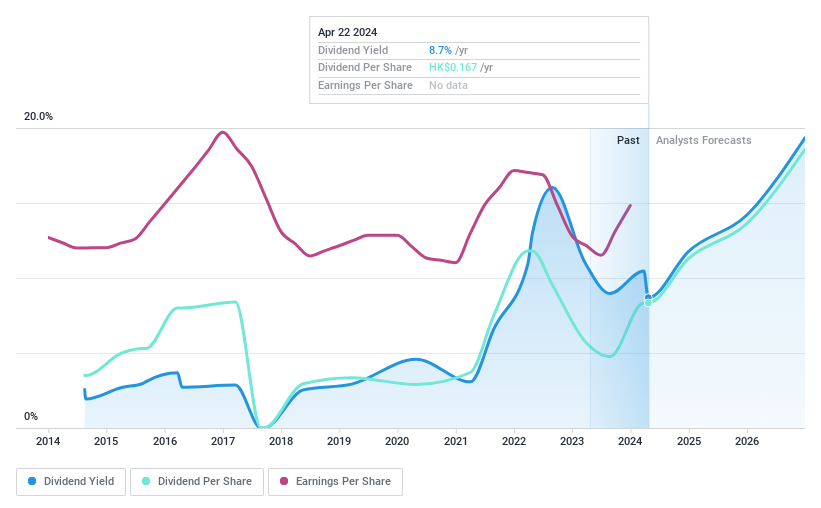

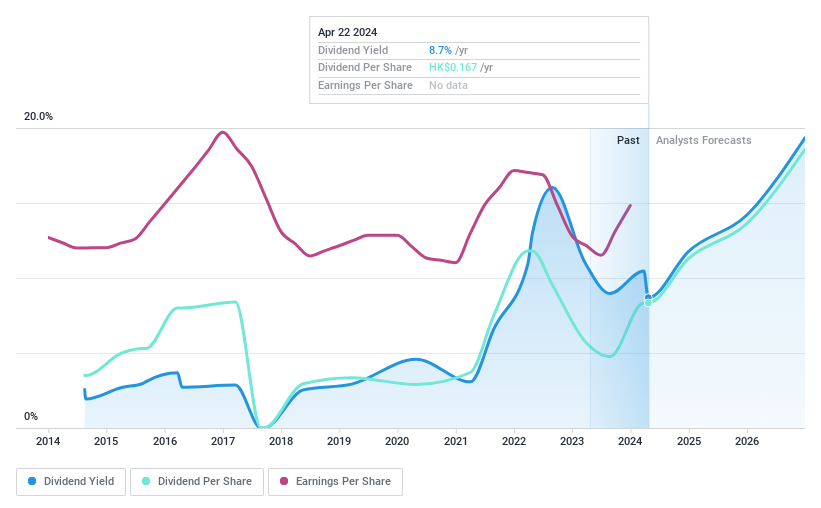

Overview: Chengdu Expressway Co., Ltd. is engaged in the development, operation and management of expressways in Chengdu, Sichuan Province, China and has a market capitalization of HK$3.48 billion.

Operations: Chengdu Expressway Co., Ltd. derives revenue from the development, operation and management of expressways in Chengdu, Sichuan Province, China.

Dividend yield: 8.8%

Chengdu Expressway offers a compelling dividend profile with a yield of 8.75%, placing it among the top 25% of Hong Kong dividend payers. The company's dividends are well supported by both earnings (payout ratio: 46.1%) and cash flows (payout ratio: 31.1%). Although the dividend history is only five years old, payments are stable and continue to rise. According to recent news, the company has withdrawn a follow-on A-share issuance, which may impact future capital strategies but does not affect current dividend sustainability.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Best Pacific International Holdings Limited, with a market capitalization of HK$2.39 billion, manufactures, distributes and sells elastic fabrics, elastic webbing and lace through its subsidiaries.

Operations: Best Pacific International Holdings Limited generates revenues in two main segments: HK$834.34 million from the manufacture and trading of elastic webbing and HK$3.37 billion from the manufacture and trading of elastic fabrics and lace.

Dividend yield: 7.3%

Best Pacific International Holdings announced a final dividend of HKD 11.38 per share for 2023, reflecting improved profitability with a forecast net profit of no less than HKD 260 million for the first half of 2024. Although the dividend yield is lower compared to the largest payers in Hong Kong, dividends are well covered by both earnings (payout ratio: 50%) and cash flows (cash payout ratio: 23.9%). However, the company has an unstable dividend record over the past decade.

Simply Wall St Dividend Rating: ★★★★☆☆

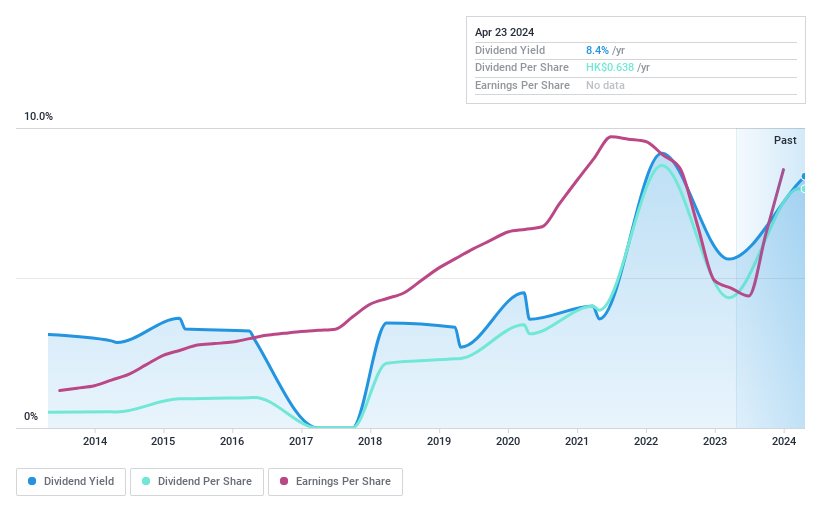

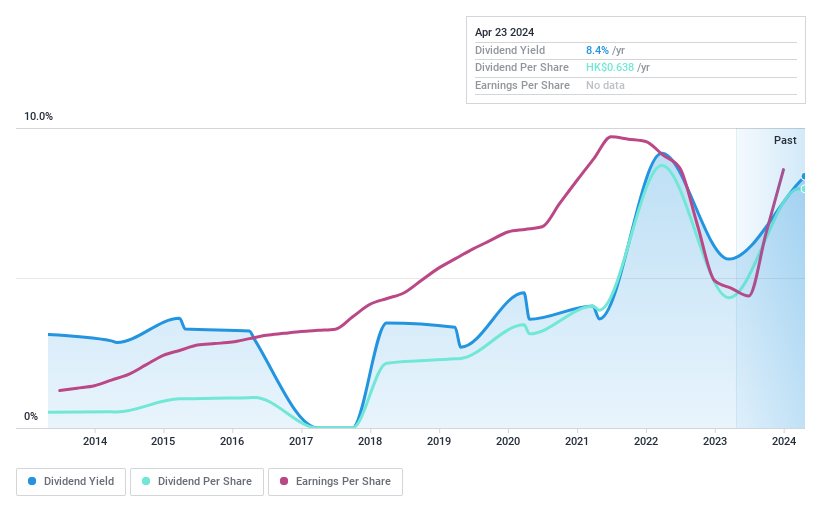

Overview: Xingfa Aluminium Holdings Limited, with a market capitalization of HK$3.28 billion, manufactures and sells construction and industrial aluminium profiles in the People's Republic of China.

Operations: The company's revenue segments include CNY 14.12 billion from aluminum profiles for construction and CNY 2.64 billion from aluminum profiles for industry in the People's Republic of China.

Dividend yield: 8.2%

Xingfa Aluminium Holdings has a mixed dividend history, with payments being volatile over the past decade. Despite this, dividends are well covered by earnings (payout ratio: 30.4%) and cash flows (cash payout ratio: 50.7%). Recent changes include the appointment of Deloitte Touche Tohmatsu as the new auditor and board reshuffles that may impact future stability. The stock trades at a significant discount to its estimated fair value, but offers a lower yield compared to major dividend payers in Hong Kong.

Take advantage of the opportunity

-

Discover the 80 hidden gems in our top SEHK dividend stocks screener with just one click here.

-

Do you already own these companies? Link your portfolio to Simply Wall St and get alerts about new alerts for your stocks.

-

Grow your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Are you looking for alternative options?

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Companies discussed in this article include SEHK:1785, SEHK:2111 and SEHK:98.

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]