- Ton liquidation reaches $7.2 million after Telegram founder's arrest.

- Fear, uncertainty and lack of investor confidence have led to high selling pressure.

The Toncoin [TON] The community is under tremendous pressure due to the arrest of Telegram founder Pavel Durov. According to the report, Durov was arrested in France and is likely to face a 20-year prison sentence. This news had a massive impact on the Telegram-based altcoin.

Ton liquidation peaks

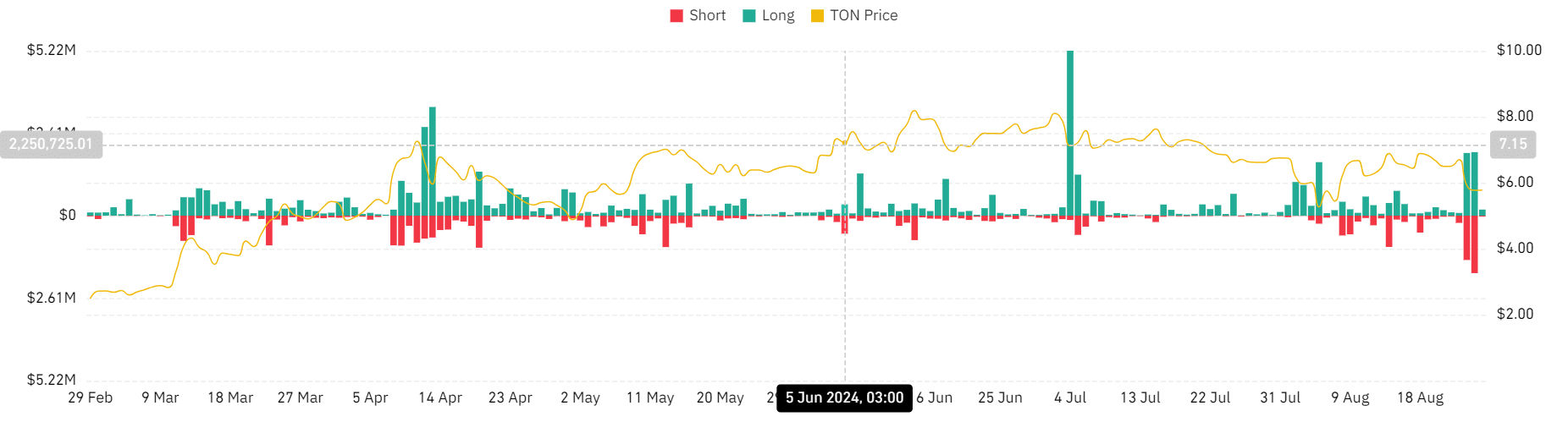

According to Coinglass data, Toncoin liquidations have reached an all-time high. Ton reported a liquidation position of $7.21 million, surpassing the liquidations reported during the market crash earlier this month.

Data shows that during the 24 hours of the August 5 stock market crash, Ton liquidations reached a record $6.5 million, mostly long positions. The recent liquidations differ as they show increased liquidation of both short and long positions.

Source: Coinglass

In particular, such a liquidation shows that the market has high volatility and rapid price fluctuations. High volatility usually leads to stop-loss and margin calls, which lead to forced liquidations.

Impact on Ton Price Charts

Since the news surrounding the Telegram founder's legal troubles, Toncoin has lost $2.9 billion in market capitalization, from $17.1 billion to $14.2 billion. The decline resulted from low trading volume, which fell by 27.3%.

Therefore, AMBCrypto's analysis shows that increased liquidation has led to a downward trend in Ton. Toncoin has fallen drastically by 18.77% on weekly charts.

This phenomenon is further supported by the declining Relative Strength Index (RSI), which has fallen from 52 to 36 at press time.

Source: Tradingview

A declining RSI shows that the altcoin is facing massive selling pressure, pushing the cryptocurrency towards oversold territory. This indicates increased uncertainty and lack of confidence among investors in the altcoin's prospects.

Likewise, the Directional Movement Index (DMI) has dropped from 23 to 16 at the time of writing. This shows that increased sell-offs have pushed the altcoins into a downtrend.

The fact that the positive index crosses the negative one above indicates that Ton's downward movement over the past day has been strong.

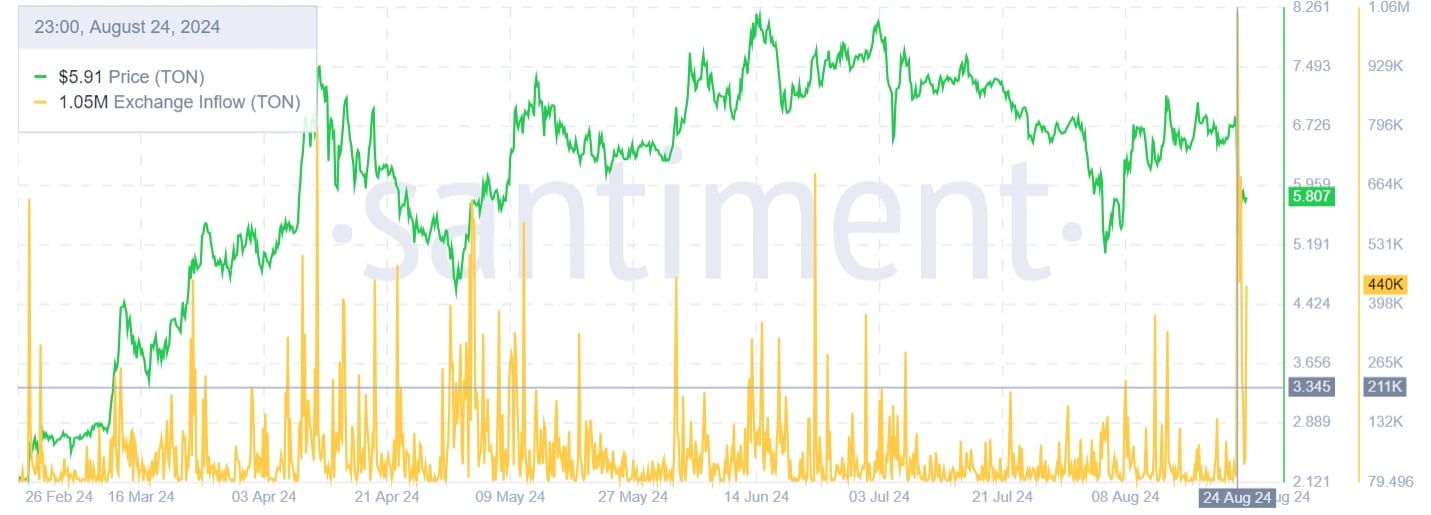

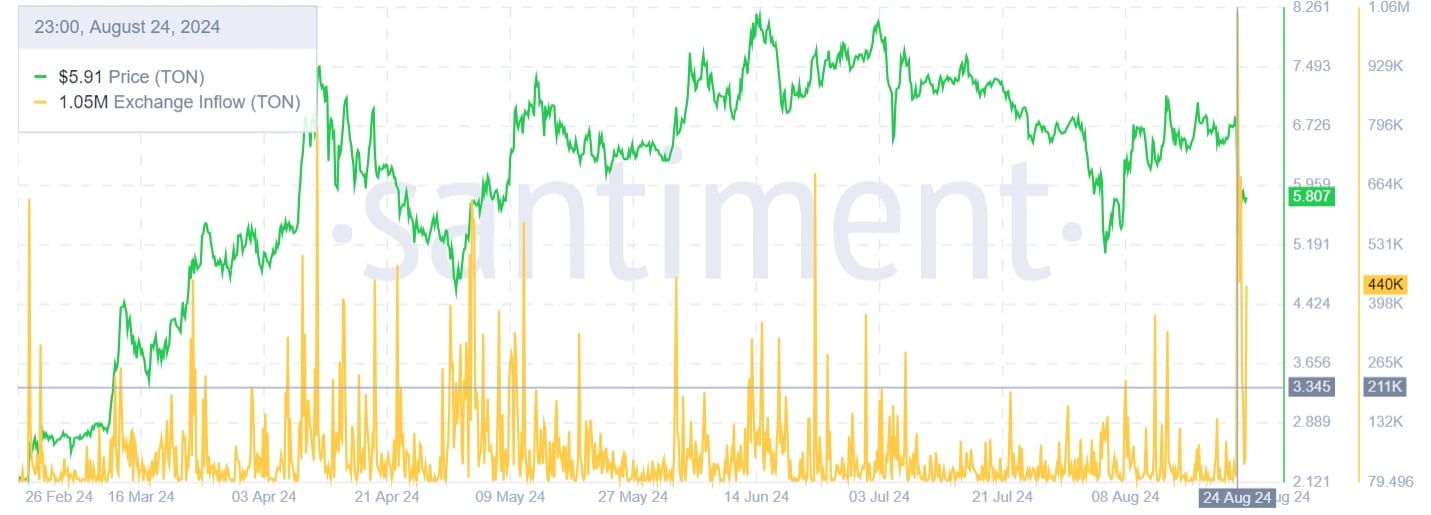

Source: Santiment

Upon closer inspection, the increased exchange inflow suggests that Ton holders are anticipating falling prices and are therefore preparing to sell. In other words, due to the negative news, investors had to take their assets to the exchange to sell them there.

As the data shows, negative news has affected market sentiment. High liquidations led to higher selling pressure, resulting in a decline in market capitalization, trading volume and prices.

Therefore, given the current market sentiment, there is a risk of the altcoin further declining to the local support level of $4.77.