U.S. Treasury yields and the changing shape of the yield curve are key indicators of market expectations for economic growth, inflation and monetary policy. Recently, yields have been falling at both the short and long ends of the curve, with short-term yields falling particularly sharply. This development led to a so-called “bull steepening” shift in the yield curve, a signal that pointed to a weakening economy, declining inflation and an increasing likelihood of interest rate cuts by the Federal Reserve.

Although yield curves provide important signals for future economic trends, they are often overlooked by equity investors, even though developments in the bond market can have a significant impact on equity returns. In this two-part series of articles, we will first examine the four main types of yield curve shifts and their economic and inflationary implications. In the second part, we will analyze what consequences a sustained bull steepening could have for the returns of the major equity indices as well as for various sectors and investment strategies.

Historical development of the government bond yield curve

The following chart shows the yields on and as well as the yield difference between the two maturities, known as the . As you may have noticed, the yield curve shows a recurring pattern that is well correlated with the economic cycle.

After a recession, the yield curve steepens rapidly, with the difference between the yields on the 10-year and 2-year bonds increasing. During a typical economic expansion, however, the curve gradually flattens until it may invert toward the end of the expansion—that is, the yield on the 10-year bonds falls below that of the 2-year.

One of the most reliable indicators of a recession is when an inverted yield curve steepens and returns to positive territory. Eventually, the yield curve rises rapidly as interest rates fall to stimulate economic activity and thus avert a recession. This repeats until the desired economic equilibrium is reached.

1. The “Baby Bull Steepening”

Recent weak labor market and economic data, combined with easing inflation, have led financial markets to expect that the Federal Reserve (Fed) will begin a series of interest rate cuts as early as September. Fed Chairman Jerome Powell also hinted in his speech at the Jackson Hole Symposium that monetary easing could be imminent. He stated:

“The time has come for an adjustment in monetary policy. The direction is clear, but the timing and pace of rate cuts will be determined by incoming data, the changing outlook and the balance of risks.”

As a result, bond yields have fallen, with short-dated bonds seeing the sharpest declines. Although it's hard to see in the chart, the recent rally in the bond market has caused the yield curve (light blue) to rise from minus 46 basis points in mid-June to nearly balanced. This brings the curve closer to the point where it will break its inversion and raise a potential recession alarm.

This movement in short- and long-term bond yields is often referred to as “bull steepening.” The term “bull” refers to falling bond yields and correspondingly rising bond prices. The distribution suggests that the shape of the yield curve is tightening, although it still remains negative.

In the second part of this article, we will analyze previous bull steepening cycles and examine how they have affected equity returns. However, to better understand the importance of the yield curve, you should know the four main types of yield curve shifts and how they affect your investment strategy.

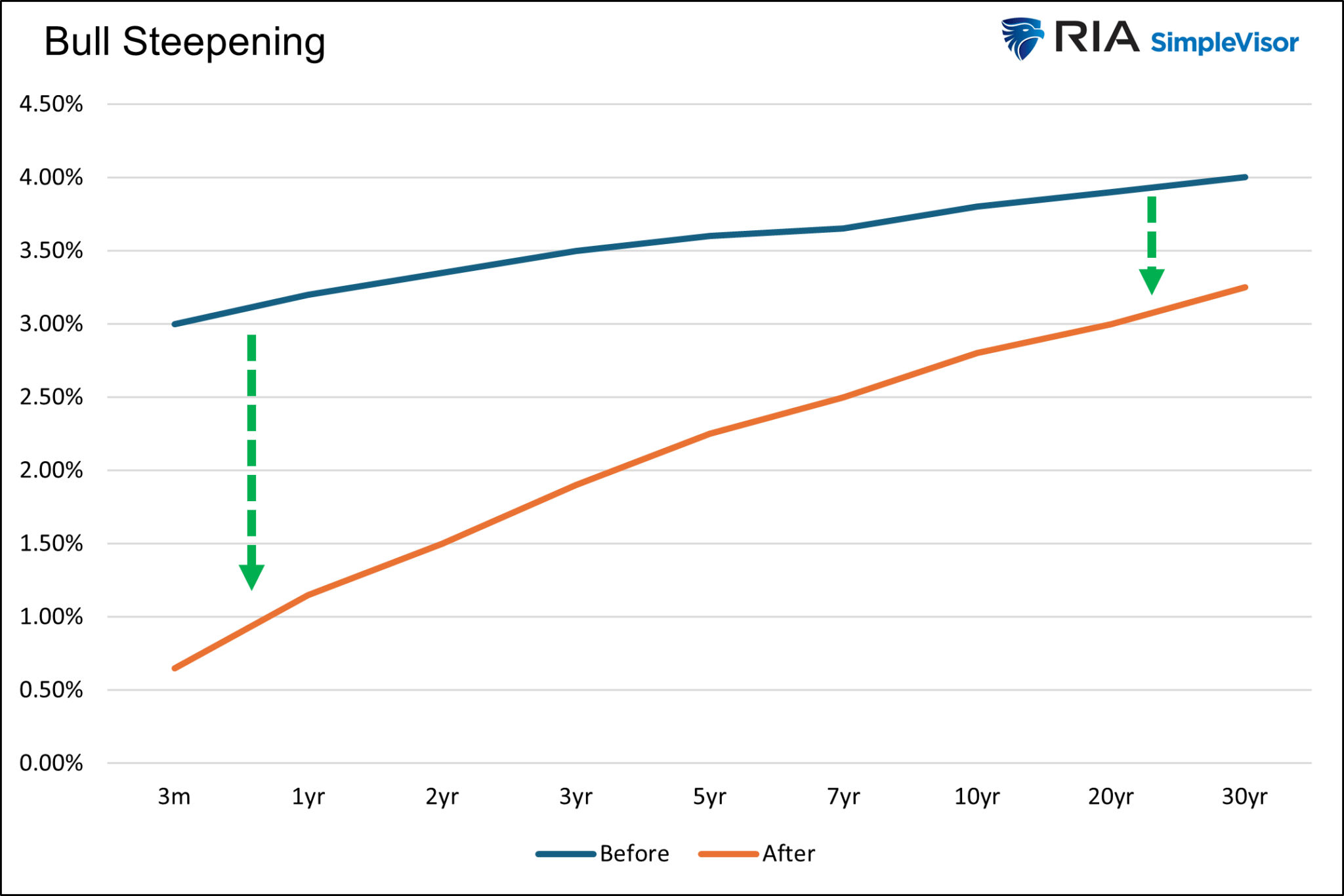

2. Bull Slope

Bull steepening also occurs when all Treasury yields fall, but shorter maturities fall more than longer maturities. In our hypothetical example below, the yield on the 2-year Treasury note falls from 3.35% to 1.50%, while the yield on the 10-year note falls from 3.80% to 2.80%. As a result, the yield curve steepens by 0.85%.

Most often, bull steepening has resulted from traders expecting monetary easing due to severe economic weakness and the increasing likelihood of a recession. Since shorter-dated bonds are more correlated with the Fed funds than longer-dated bonds, it is logical that they would fall faster when such expectations arise.

The recent bull steepening has been textbook. The rate has risen from 3.7% to 4.3% this year, and in general many economic indicators point to slower growth. In addition, inflation appears to be trending further downward, prompting the Fed to cut interest rates further. Powell's speech in Jackson Hole states:

“I am increasingly confident that inflation is on a sustainable path back to [unserem Ziel von] 2%.”

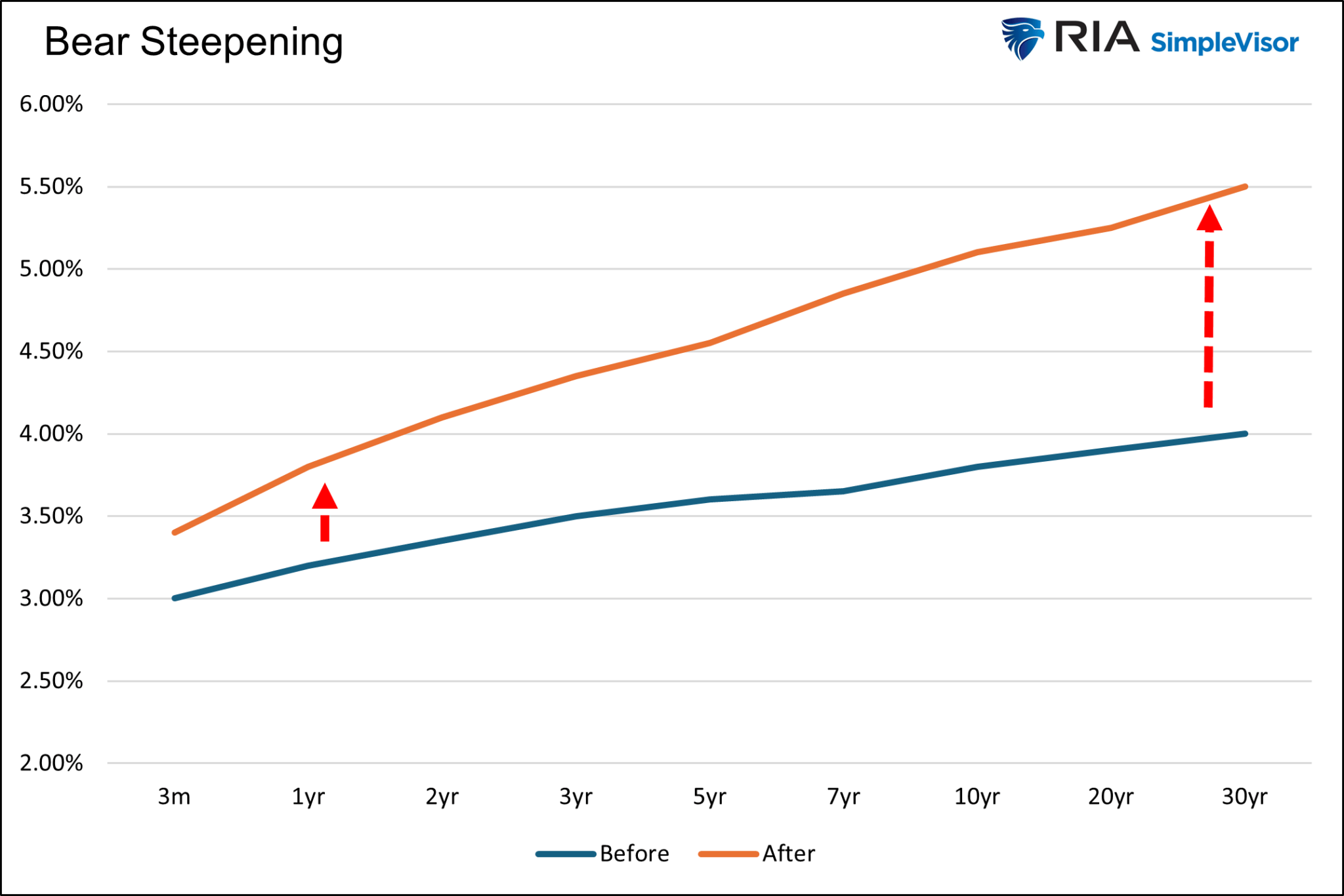

3. Bear steepness

As the name “bear steepening” suggests, yields on both short and long-term maturities rise, with longer-term yields rising more than short-term yields. In the chart below, the yield on the 2-year Treasury note rises from 3.35% to 4.10%, and the yield on the 10-year Treasury note rises from 3.80% to 5.10%. The result is an upward shift in the yield curve from 0.45% to 1.00%.

.

In 2020 and 2021, the yield curve shifted in this direction. Back then, the Fed cut interest rates to zero and implemented massive QE measures. Bond yields then rose in anticipation of a recovery in economic activity and growing inflation concerns due to massive fiscal and monetary stimulus.

Short-term yields are not moving as much as long-term Treasury yields. This happened because the Fed had pledged to keep interest rates very low to fight the pandemic. Bear steepening occurred again in late 2023 as the economy continued to run above its natural rate despite Fed Funds at 5%. The higher interest rates had no significant impact on the economy and inflation did not fall further.

The market assumes that the Fed will have to raise interest rates further. However, demand for money market investments was insatiable due to high cash and money market balances, which helped keep short-term interest rates low. At the long end of the curve, investors had to absorb large-scale issuance of government bonds. They demanded higher yields in return. This effect is known as the rising term premium.

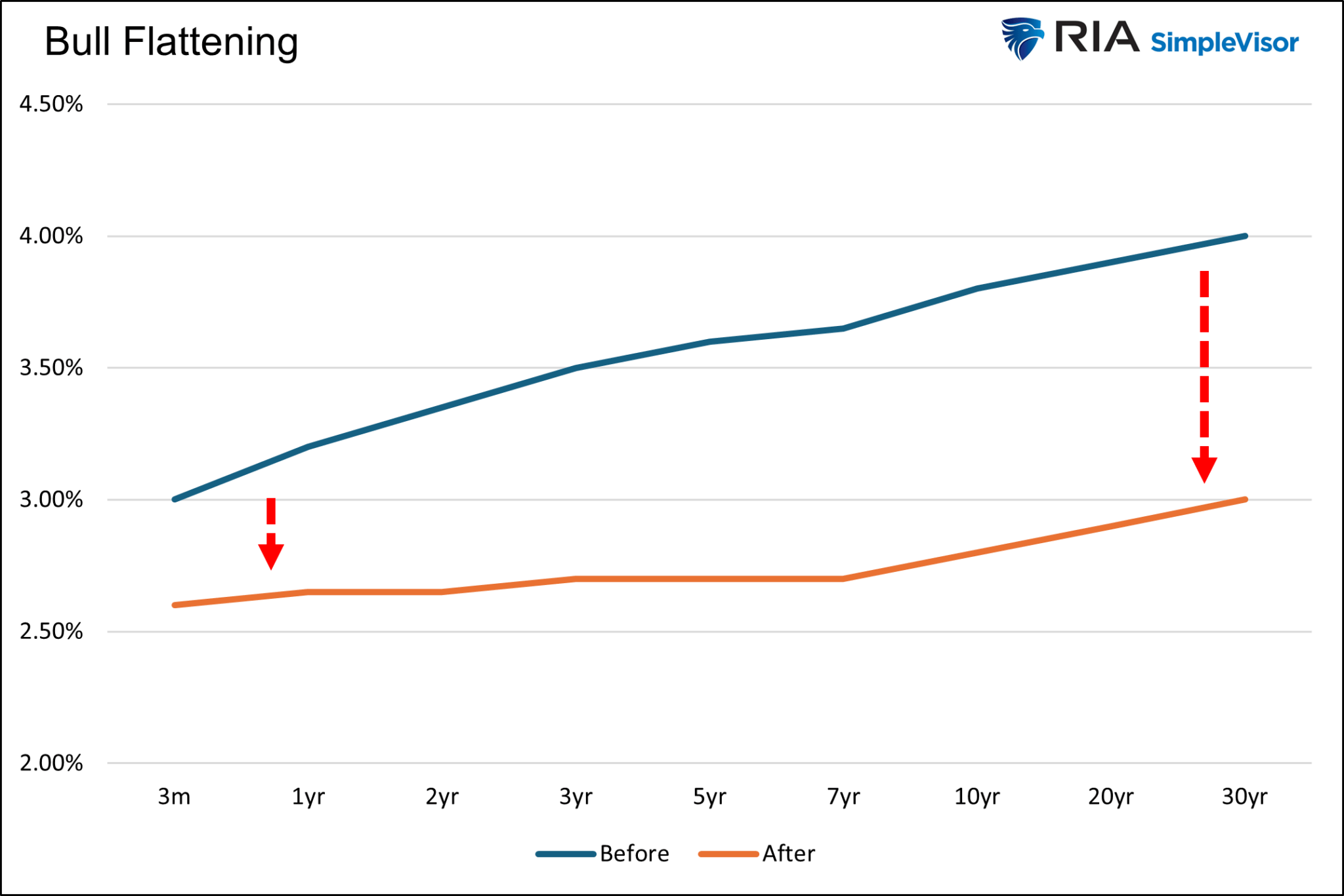

4. Bull Flattener

In a bull flattener, yields on both short and long-dated bonds fall, with yields falling more sharply at the longer end. The chart below shows a contrast of 2-year yields at 0.70% and 10-year yields at 1.00%. Because long-term yields have fallen more than short-term yields, the difference between the two yields is converging, flattening the yield curve. The “net effect” of this move is a reduction in the difference, in this case by 0.30% (1.00% – 0.70%), resulting in a flattening of the yield curve by 0.30%.

Bull flattenings are usually the result of relative economic optimism. The market is encouraged because inflation is likely to fall, but it is not overly concerned that lower inflation is due to weakening demand. Therefore, investors are not expecting much in the way of Fed rate cuts.

Conversely, the market may be concerned about the state of the economy, but when interest rates are at or near zero, there is no room for an unexpected move at the short end of the yield curve. 2016 is a good example of this.

The benchmark interest rate was already at zero, the economy was in a slump, and inflation remained below the Fed's target. Longer-term bonds fell with inflation and the economic outlook, while shorter-term bonds were stuck as the Fed refused to cut rates below zero.

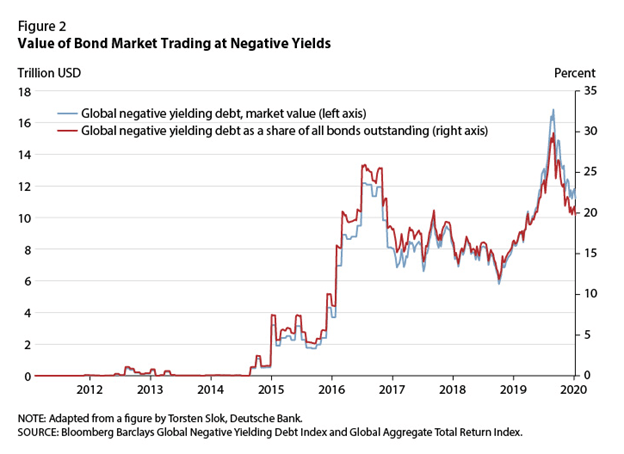

The chart below, which we use with permission from Deutsche Bank (ETR:), shows that the dollar value of global negative yielding bonds rose sharply in 2016. Despite international trends, US yields remained largely above zero percent.

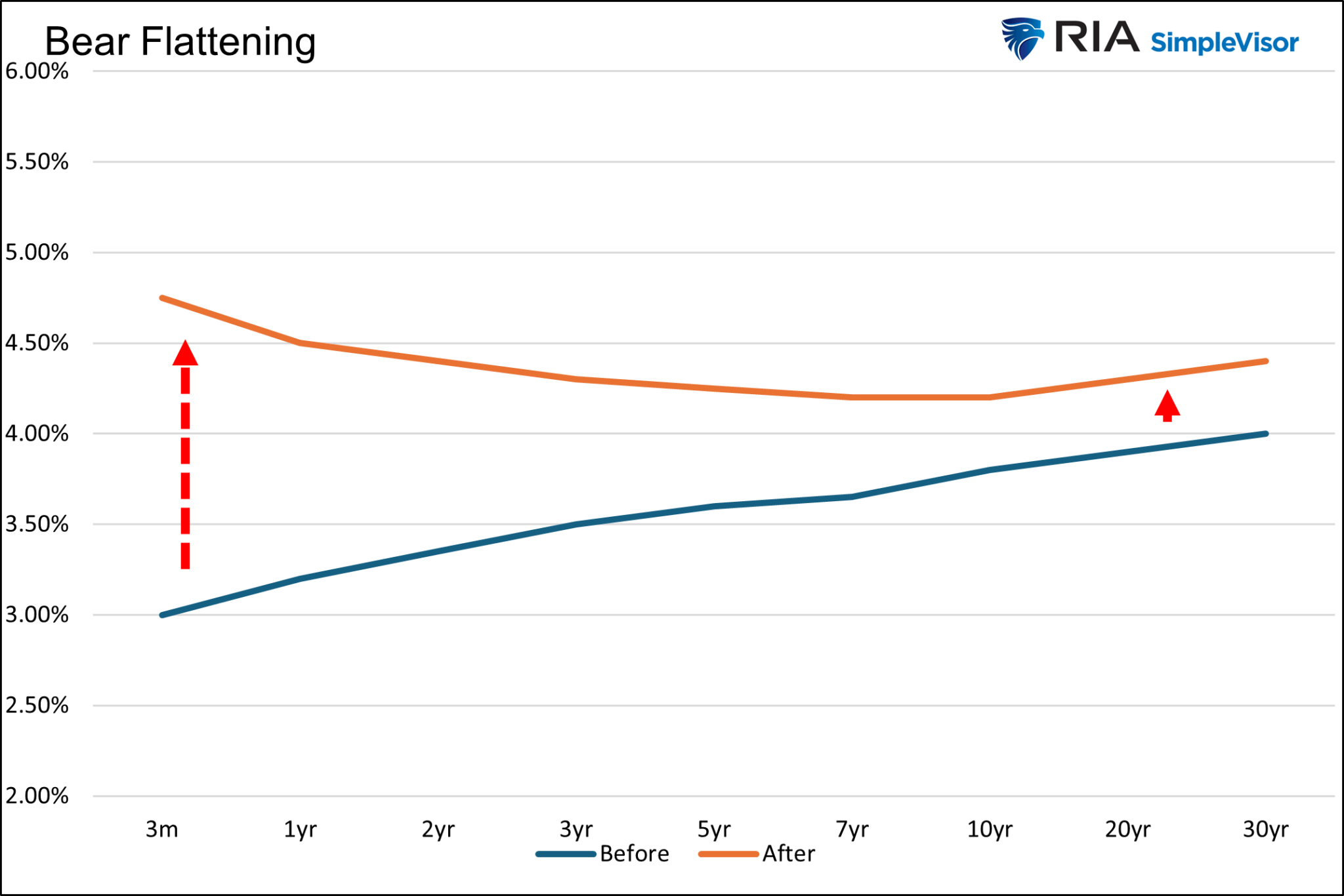

Flatten bears

Bear flattening occurs when yields rise across the entire curve, with shorter maturities rising the most. The yield on the 2-year Treasury note rises from 3.35% to 4.40% in the figure below. The yield on the 10-year bond rises from 3.80% to 4.20%. The curve flattens and inverts from 0.45% to -0.20%

Conclusion

Given the increasing attention yield curves are receiving, it is appropriate to examine the current shift in the yield curve. What could a bull steepening mean for equity indices, sectors and factors?

Here's a good tip: The stock market seems to love the idea of the Fed cutting rates before it actually does. However, when the Fed cuts rates, the result is usually not very pleasant for stock investors.